Based on internal research by BSV Blockchain, business consultants are the most enthusiastic to educate themselves about blockchain technology.

While blockchain education addresses the first of their pain points, the second, without which no progress can be made, is to motivate their recommendations to their clients.

And here lies the rub: Where engineering-minded consultants are fluent in the technical considerations behind their recommendations, the C-suite is focussed on how a blockchain solution will impact the efficiency of operations, future-proof their business, affect information security, enhance or detract from ESG, and most importantly, impact the bottom-line.

To guide consultants in translating their blockchain solution into C-suite speak, we spoke to Shawn Ryan and Bryan Daugherty, Co-Founders of blockchain distribution channel, SmartLedger solutions, and CDO, Gregory Ward.

A matrix for pitching blockchain as enterprise solution

The business utility of a blockchain solution

Business opportunity of monetising your data

Impact on the bottom-line |

Ryan and Daugherty offer you the following matrix to use when you analyse different blockchain solutions, in order to successfully communicate your recommendation to even the most analytical of board members.

The business utility of a blockchain solution: real-time data sharing

For Ryan, the utility of a blockchain solution is an obvious place to start, as any proposal based on the speculative value of a solution is bound to fail.

Blockchain’s major value propositions for businesses are achieved through its unique data management properties for securing data, authenticating ESG data, the cost efficiencies of peer-to-peer data sharing, and gains in operational efficiency.

Present the C-suite with the value your proposed blockchain solution provides in the following areas:

Securing data

For modern enterprises, secure communication is a never-ending concern. Can your blockchain solution address the risks and cost of securing data?

In the case of the BSV blockchain, it meets and exceeds the critical requirements of information security with a newer, more resilient architecture.

In recognition of the BSV blockchain’s proposition of securing corporate data, Certihash and IBM Consulting, the professional services and consulting arm of IBM, are building a new ‘Sentinel Node’ cybersecurity detection tool on the BSV blockchain to greatly reduce the time required to identify a data breach and therefore the total cost of cyber-attacks against enterprises.

Authenticating ESG data

ESG compliance is one of the top concerns for CEOs. Depending on the chosen blockchain, this technology can offer an honest, open, and stable architecture, providing the foundation for connected systems that can help to make better real-time decisions, increase the efficiency of energy usage and improve overall quality of life.

The Proof of ESG initiative, led by Daugherty, incorporates an agenda to reimagine ESG reporting through strategic blockchain reinvention and business transformation – empowering the foundation of ESG reporting with a universal source of truth.

Efficiencies of peer-to-peer sharing

Entrepreneur Stephan Nilsson with 20 years experience as an SAP integration architect in the enterprise system world claims that in efficiency terms, 80 per cent of supply chain operations are waste. It’s ‘making the whole world economy stagnate,’ he says.

A properly scoped blockchain system enhances a business’ operations by removing data silos to enhance decision-making – translating into an increase in profits.

At the same time, a peer-to-peer data and value sharing model can eliminate the costs of intermediaries while the interoperability of a public blockchain can remove the need for integrations within a company, as well as across a supply chain.

In the case of the BSV blockchain, the BSV Technical Standards Committee (TSC) is particularly focussed on increasing its utility by enhancing interoperability through standardisation.

The business opportunity of monetising your data

Traditionally, there is no native way to transmit payments with data. But with blockchain, we are creating payment layers that fuse data and money. With the BSV blockchain, the data is on a public ledger, and has a native currency, BSV, that you can use to pay for access and use of that data.

Transmira is one of the companies using this solution within the AR and VR world to power smart cities. When people engage in smart cities with their devices, they also need a way to interact with them with respect to money – to value items and buy or sell them.

That is what Transmira is doing with its system – using the BSV blockchain to tokenise assets and real estate in the virtual world and allowing you to interact with them in a monetary way.

Blockchain sustainability

Due to the false assumption that proof-of-work consensus mechanisms are computationally unscalable and overly energy consumptive, many have sought to find more ‘environmentally friendly’ ledger systems.

However, blockchains such as Ethereum that plan to implement a proof-of-stake consensus model are more vulnerable to being breached, since the cost of attacking the network is lower than proof-of-work models. Ethereum-based systems are also at greater risk of Sybil attacks, where the attacker disrupts the network by creating a number of misbehaving nodes.

Don’t sacrifice security for a false sense of environmental sustainability!

Make sure you’re prepared to address and correct misunderstandings about blockchain’s sustainability by getting a firm grasp on the following concepts:

Environmental sustainability via scalability

Contextualising blockchain’s energy use is pivotal to overcoming the misconception that it is a bane to the environment.

Blockchain technology hinges on the concept of economy of scale comparable to a transport infrastructure, such as a railway that runs according to schedule. The train will leave the station whether the coach is empty or full of passengers, consuming the same amount of electricity regardless of its load.

An efficient system requires that the platform accommodate the maximum number of people to reach each train’s optimal capacity. That way, the energy consumption is divided by the number of people benefiting from the service.

Similarly, blockchain infrastructure can economise on electricity consumption by fitting as many transactions as possible into each block to make the mining process more energy efficient.

In the case of the BSV blockchain, scaling makes up one of its four technical pillars.

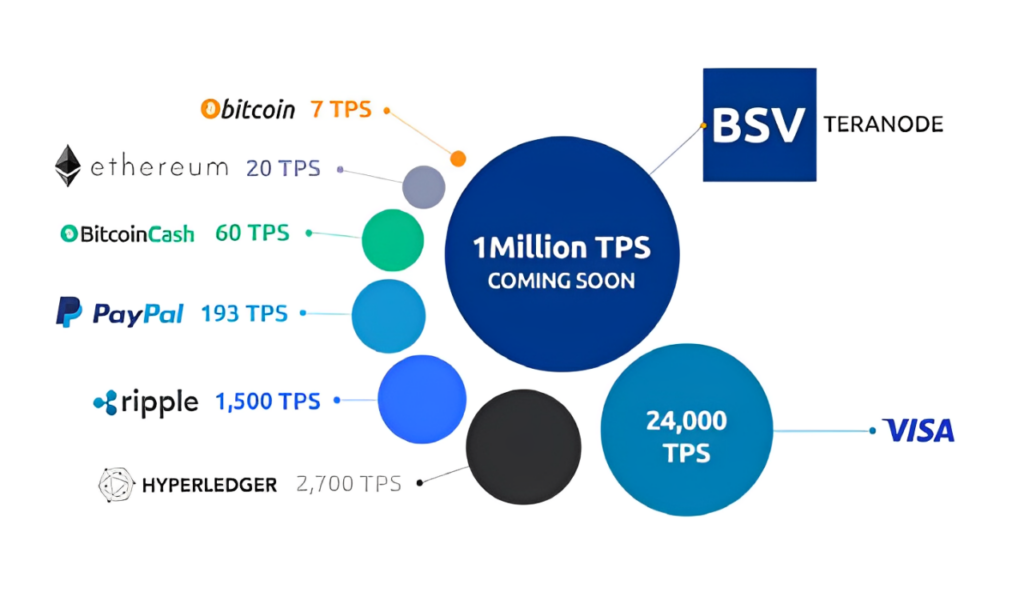

In 2024, the BSV Blockchain R&D team announced groundbreaking features for their upcoming architecture upgrade, Teranode that will significantly boost network efficiency and speed, pushing BSV’s capabilities from 5,000 transactions to 1 million transactions per second.

Teranode solves vertical scaling challenges on the BSV network by serving high-volume transaction nodes for enterprise and government use. Whether contracting with nodes or running their own, these clients drive the Teranode initiative.

Protocol custodian BSV Blockchain revealed a more service-oriented approach to the network’s work. The new features include ‘modularized’ functions such as transaction and block validation, plus block assembly into services that run only when required.

Teranode is soon to begin extended and sustained testing on a Proof of Concept implementation this month, with a full node release later in 2024. This is a significant upgrade for the BSV node software, and it is a ground-up rewrite of the BSV Blockchain architecture, designed to scale horizontally and provide new microservices for developers, applications, and users.

Cost of use vs cost of ownership

The scalability of a blockchain is also a determining factor in the cost of employing the technology. While the notion of a ‘private blockchain’ might be tempting, it is often based on the false dichotomy between public and private blockchain.

Detracting from the value of a private blockchain are the facts that it reintroduces a central point of failure and increases the cost of ownership and use due to the limited scale – and therefore the environmental impact.

Make sure you’re able to explain how a public blockchain can be used for managing the most sensitive of data (with use cases to back that up) to benefit from the scaling efficiencies of a public blockchain, like BSV.

Regulatory compliance

While many blockchain’s pride themselves in maintaining the anonymity of their users, these networks’ open themselves to immense regulatory vulnerabilities in a legal landscape that demands KYC and AML compliance.

The BSV blockchain, on the other hand, boasts a traceable, yet private data management system and a regulation-compliant approach.

The BSV Technical Standards Committee is one of the bodies in the BSV ecosystem focussed on ensuring regulatory compliance, by standardising blockchain operations in line with relevant laws. The Travel Rule specification is one such example, where the TSC is designing a standardised protocol for VASPs on the BSV blockchain to collect and exchange the information required by the Financial Action Task Force.

Interoperability with future apps

Enterprises should be mindful of the stability of a protocol before they commit time and resources to building their applications on top of it, to ensure that applications they build, and the monetary and data transaction they perform today, or schedule for future execution, will be valid in 2, 5 and 100 years from now.

Just like a stable Internet protocol supported the rapid growth of online services, a stable blockchain protocol is required to give enterprises comfort they are building on a platform that is reliable – not in a constant state of flux like competing platforms.

In the case of the BSV blockchain, the Genesis upgrade of February 2020 restored many technical functions of the original Bitcoin protocol and locked the protocol.

While it may experience software improvements, the BSV ecosystem is committed to keeping its basic technical “rule set” now set in stone, as Satoshi Nakamoto always envisioned.

The TSC also plays a significant role in ensuring the interoperability of applications within the BSV ecosystem through standardisation. By building on such a stable foundation, businesses are assured their own applications will be supported in future, and compatible with other applications across the value chain.

Availability of data

The availability of data is a major concern for businesses, who spend considerable resources on preventing downtime and data loss. Organisations with mission-critical needs that want to ensure a high availability data environment implement additional measures to improve availability such as redundancy, failover and a comprehensive disaster recovery plan.

Unfortunately, in today’s information security infrastructure, data availability cannot always be controlled. This is due to the reliance on the types of services available, which can change depending upon geography or resources and are subject to the forces of nature. For example, many businesses that are located outside a service provider’s infrastructure are limited by the types of connections and network models they can deploy due to factors such as available bandwidth.

The BSV network model is based on the original Bitcoin network, as Satoshi Nakamoto described in the white paper, which “…requires minimal structure”.

Nodes are incentivised to form a small-world network (near-complete graph) to ensure fast communication. This is like the control centre of a hub and spoke network but different because Bitcoin is a distributed global network; there is no central governance, and nodes only need to adhere to the established rules to participate. As nodes join and leave the network, block difficulty will adjust to maintain a consistent 10-minute average pace of discovering new blocks. This allows the network to self-heal, preventing downtime and ensuring 100% availability.

The business case for blockchain

‘We still have a tendency to put blockchain in a box, whereas blockchain allows you to redefine the boundaries of the box. Rather than thinking about blockchain being a swap for something that exists, blockchain gives you the ability to rethink how you do business or solve challenges.’ nChain’s Director of Commercial & Strategy, Simit Naik

Enterprise leaders may find it difficult to understand the nuts and bolts of blockchain technology. And yet, the business case for its implementation speaks volumes. Make sure you translate your pitch into C-suite speak, and you’re bound to make an impression.